NTUC Income Case Study

| ✅ Paper Type: Free Essay | ✅ Subject: Business |

| ✅ Wordcount: 2148 words | ✅ Published: 31 Jul 2017 |

Introduction

NTUC Income was founded in 1970. NTUC Income is the only insurance co-operative in Singapore. It was established to make essential insurance accessible to all Singaporeans, they are now a leader in life, health and general insurance. On June 1, 2003, Income succeeded in the migration of its information systems and business processes to a digital web based system. Following the major IT Investments, the Orange Revolution was launched in late 2011, targeting existing and potential customers. Orange aims to make insurance at NTUC Income “simple, honest and different” and to change practices in the insurance industry by “doing things differently”.

Case Study Questions

- What types of Information Systems and business processes were used by NTUC Income before migrating to the new digital systems? What were the problems associated with the old systems?

NTUC Income used the HP3000 mainframe that hosted their core insurance applications together with their accounting and management information systems. The system was unreliable and frequently broke down. NTUC Income’s in-house IT team maintained decades old COBOL programs which also regularly broke down causing disruptions.

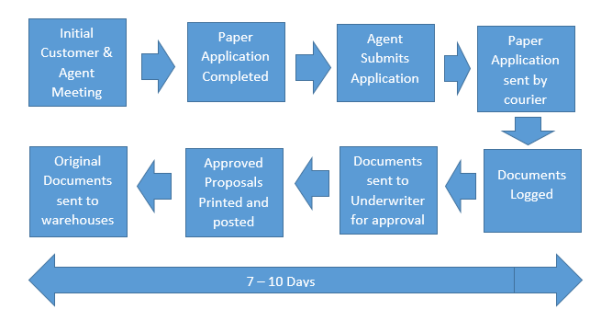

The business processes used by NTUC was a paper based system as outlined in the following diagram;

Problems associated with the old systems;

- Income’s insurance processes had become very tedious and entirely paper based.

- The collection schedule of completed applications could introduce delays in processing documents of two to three days. Increased delays could cause financial and reputational damage to the business.

- All original documents were sent to warehouses for storage. In all, paper policies comprising 45 million documents were stored in over 16000 cartons at three warehouses. The storage system used by NTUC Income would have resulted in high financial costs in logging and storing the documents. Also, NTUC Income would have needed to invest heavily in the security of their warehouses to ensure customer information was properly protected.

- Retrieval of documents took two days and refiling a further two days. This was a slow process and not an efficient service for customers.

- HP3000 mainframe was unreliable and frequently broke down.

- COBOL programs regularly broke down causing disruptions. NTUC Income’s in-house IT team found it cumbersome to develop products in COBOL which extended new product launch times.

- Transaction processing for policy underwriting was still a batch process and information was not available in real time. When staff processed a new customer application for motor insurance, they did not know if the applicant was an existing customer and cross sale product opportunities were lost.

- Various departments did not have up-to-date information and had to pass physical documents among each other.

- Describe the digital systems capabilities at NTUC Income after migrating to the new system. How did the systems resolve their problems?

In 2003 NTUC Income switched to a Java-based eBao Lifesystem from EBao Technology. As part of the eBao implementation, Income decided to replace its entire IT infrastructure with a more robust, scalable architecture. Examples include the following;

- Scanners for all servicing branches

- Monitors changed to 20 inches

- PC RAM size was upgraded to 128MB

- New hardware and software for application servers, database servers and web servers

- Disk storage systems were installed

- LAN cables were replaced with faster cables, a fiber-optic backbone and wireless capability

|

Capability |

Problems Resolved |

|

eBao system integrated imaging and workflow technology. |

500 office staff and 3400 advisors could access system anytime, anywhere. |

|

System provided single customer view of each customer across products and channels. |

Facilitated cross selling and improved customer service. |

|

All applications resided on two or more servers, each connected by two or more communication lines, all of which were “load balanced”. |

This minimised downtime. |

|

A Real time hot backup disaster recovery centre was implemented where machines were always running and fully operational. |

In the event of datacentre site becoming unavailable, operations could switch to disaster recovery site. |

|

Under new paperless system, all documents were scanned and stored on trusted storage devices. |

Secure and reliable and enabled strict compliance with stringent statutory requirements. |

|

NTUC’s life and general insurance operations now ran on one integrated platform. |

Provide efficient workflow, high flexibility and customer centric view. Time to process applications was cut in half (Kang). |

|

Imaging and barcode technology. |

Speed and accuracy of locating data and less errors. |

|

Product definition module. |

Supports new products and speeds up product launches. |

- Speculate on how the new digital systems provided a basis for the “Orange” strategy. Could Orange have been possible with the old systems? Explain.

The Orange Revolution was launched in late 2011 with the aim of making insurance at NTUC Income “simple, honest and different” and to identify and resolve major issues customers experience when dealing with insurance firms. The methods used to implement the “Orange” strategy include;

- Orange Force – fleet of motorcycles which can arrive at a traffic accident within 20 minutes and can help with first aid, help fill out insurance forms and offer advice on the scene.

- Orange Eye – Uses in car cameras to record and help combat fraud.

- Orange Speak – Fair and easy to understand terminology in insurance policies

- Orange Settle – A quicker and fairer way of settling claims

- Orange First – Transformation of the distribution channel for selling policies

- Orange Prime – Creation of a new sales force.

The new digital systems enabled greater efficiencies and in turn enhanced customer service and provided a platform for the Orange strategy. The new systems provided the backdrop which enabled the Orange strategy to be implemented.

- The digital systems were immediately operational on a high availability platform. The robust architecture minimised downtime occurrence due to hardware or operating system failures. NTUC could now operate the Orange Strategy with the confidence that the new digital systems provided.

- The move to a paperless system cut the time and cost needed to process policies by 50%. The functionality of the new digital systems meant that staff could access information quicker as the system provided a single view of each customer. As a result, about 500 office staff and 3400 insurance advisers could access the system anytime, anywhere. The new digital systems facilitated improved customer service and cross-selling opportunities because of quicker end to end processing. Also, the new systems by providing efficient straight through processing workflow and a customer-centric view, provided a platform for the Orange strategy which involved becoming more customer focused.

The “Orange” strategy would not have been possible with the old systems. The strategy is effectively based on honesty and trust and delivering first class customer service which requires quick, reliable and accurate data in real time.

- The old HP 3000 system took 7 -10 days to put a new policy in place. This would not suffice as good customer service and could not support the “Orange” strategy.

- In relation to the “Orange Force” stage in the Orange programme roll-out, an important factor is the requirement for real time information. Digital images, voice recordings and up to date information could not have happened with the old system.

- The new systems integrated imaging and paperless workflow technology. As a result, all office staff and insurance advisors could access the system anytime, anywhere. This was key technology for the new strategy as this information is required instantly e.g. “Orange Force” call out.

- The old systems had frequent failures, breakdowns and outages. This would absolutely ground the new strategy as “Orange Force” requires up to the minute data to locate and assist breakdowns. The old systems were too unreliable, a long-term breakdown would be catastrophic.

- The new systems provided a single view of each customer. This gave NTUC Income a better insight into the customer and facilitated cross selling and improved customer service. This was not possible with the old systems.

In conclusion, the Orange Strategy would have been guaranteed to fail with the old systems which could not provide the functionality, security or reliability required to implement the Orange strategy. The new digital systems provided many new capabilities which facilitated the successful implementation of the Orange Strategy.

- Set out three important lessons for Irish retail banking which can be drawn from the NTUC Case Study. What are the implications of these lessons for your bank?

Three important lessons for Irish retail banking which can be drawn from the NTUC case study are the following;

- Investment in IT

Irish retail banking must continue to invest heavily in IT to ensure that customer data is accurate, secure and always available. Customers want new services based upon 21st century technologies. Technology helps banks to service their customers through their various banking channels. NTUC Income’s investment in technology represents their commitment to identify and resolve major issues customers experience when dealing with insurance firms.

Ulster Bank was fined €3.5m by the Central Bank for disruption to its technologies when IT failures affected 600,000 customers in the summer of 2012. The financial authority also reprimanded the bank over the issue and said it had failed to have adequate governance and control measures to deal with problems within its technology systems. The IT issues occurred over a month-long period between June and July 2012 and affected customers’ ATM withdrawals, card purchases and the processing of payments including salaries. The Central Bank said that financial firms were required to maintain robust governance arrangements and appropriate controls across all of their systems, including IT.

The Central Bank said the fine reflected the seriousness with which it viewed the failings of Ulster Bank and its determination to ensure that customers have access to core banking services without disruption.

This case demonstrates the importance of the requirement for continuous investment in technology and system upgrades as the consequences are outages, failures, negative publicity and ultimately a loss of business and reduction in profits.

- Importance of the customer and culture

Branches and traditional products and services still are desired by many customers but people want more than this and financial institutions are trying to improve the customer experience and deliver the products and services demanded by digital consumers. Banks can now interact with customers through a variety of channels e.g. call centres, retail branches, online channels, apps, which are all enabled by a digital service infrastructure.

NTUC Income’s culture had to be altered slightly so that their organisation could become more active, energetic and contemporary, essential attributes for cooperatives to compete and succeed. This shift in culture made NTUC Income more innovative, they listened and engaged with their customers and responded to their feedback. The importance of responding to customers concerns and needs should be prioritised by Irish retail banking and banks need to be prepared to adjust their culture accordingly.

Ulster Bank is in the process of attempting to transform the bank because of customer changing requirements. Ulster Bank recently announced it is to close 22 of its branches across the country. Ulster Bank stated that the announcement follows a customer shift away from traditional in-branch banking towards digital channels. Last year 62% of Ulster Bank’s customer interactions were digital, compared with 10% in branches. This case demonstrates Ulster Bank’s commitment to respond to their customers changing needs.

- Innovation

There is a requirement for Irish retail banking to be innovative and keep up to date with customer needs, technology and changing environments. The relationship between Irish retail banking and consumers is rapidly changing, with interactions increasingly occurring on mobile devices, in real time with contextual benefits. In 2013, 968 million smartphones were sold globally. Digital banking trends cannot be ignored by Irish retail banking and need to be central to Irish retail banking strategy as we approach 2020. Ulster Bank like NTUC Income with its Orange Force strategy must continue to meet customers ever changing needs with innovative new ideas. In this regard, Ulster Bank have recently demonstrated that customer-centric innovation is important to the bank, when they announced their partnership with Apple in bringing mobile payments to the everyday lives of Irish people. Apple Pay will make mobile payments easier for Ulster Bank customers. They will be able to pay for goods and services anywhere contactless payments are accepted, using their iPhone or Apple Watch. Like NTUC Income, Ulster Bank is responding to their customers changing needs and putting “people before profits”.

Conclusion

NTUC Income changed its culture from the top down. NTUC Income put their entire business on the line in changing their business systems and processes. They moved from systems with many limitations to implementing new technologies. It was a change which proved very successful. It allowed NTUC Income to go back to basics, putting their customers first, caring for customers, understanding their needs and responding to those needs. They instilled this culture whereby they placed “people before profits” throughout the organisation which lead to them gaining customers trust and increasing profitability.

Bibliography

Laudon, Kenneth C., and Jane P. Laudon. “Management Information Systems: Managing the Digital Firm” (Fourteenth Edition)

Reference to Course Notes (Workshop 1), 1st March 2017

https://www.income.com.sg/about-us/corporate-profile

http://marketing.ie/ulster-banks-goes-outdoor-with-apple-pay/

http://www.rte.ie/news/2014/1112/658589-ulster-bank-fine-it/

https://www.virginmedia.ie/pdf/VM_IE_Digital_Insights_Report.pdf

https://www.rte.ie/news/business/2017/0323/862013-ulster-bank-to-close-22-branches-across-ireland/

Cite This Work

To export a reference to this article please select a referencing stye below:

Related Services

View allDMCA / Removal Request

If you are the original writer of this essay and no longer wish to have your work published on UKEssays.com then please click the following link to email our support team:

Request essay removal